It helps investors determine if a stock is overvalued or undervalued based on the company’s actual worth. Perhaps one of the most significant limitations of BVPS is that it often fails to account for the true value of intangible assets. Book value is calculated based on the reported value of a company’s tangible assets – such as buildings, equipment, and inventories – minus any liabilities.

Intangible Assets

The book value of a company is the difference between that company’s total assets and total liabilities, and not its share price in the market. Book value per share (BVPS) measures the book value of a firm on a per-share basis. BVPS is found by dividing equity available to common shareholders by the number of outstanding shares. The book value can act as a valuable tool in M&A scenarios, as it provides insight into a company’s value on its balance sheet.

Correlation between Book Value per Share and Market Value per Share

Companies with a low book value could be undervalued, making them potentially attractive for investors seeking profitable investments. These companies might be in a growth phase, reinvesting profits into expansion rather than accumulating assets. If a company acquires substantial new assets using its profits, the book value will potentially rise, assuming no change in the number of outstanding shares. Conversely, if the company takes on additional liabilities, the book value per share may decline as net assets decrease.

Cash Flow Statement: Breaking Down Its Importance and Analysis in Finance

Over time, these actions can increase the book value per share as the company gains a competitive edge through improved brand reputation, increased customer loyalty, and reduced risks. Another angle from which to view book value per share is as a sort of safety net. If a business were to liquidate, theoretically, the book value per share is the amount that each shareholder would receive. Of course, this is often seen as a worst-case scenario, but it provides a base level of protection for investors. When the price that you pay for a share is close to or below its book value, it limits the potential downside of an investment, although it doesn’t exclude it.

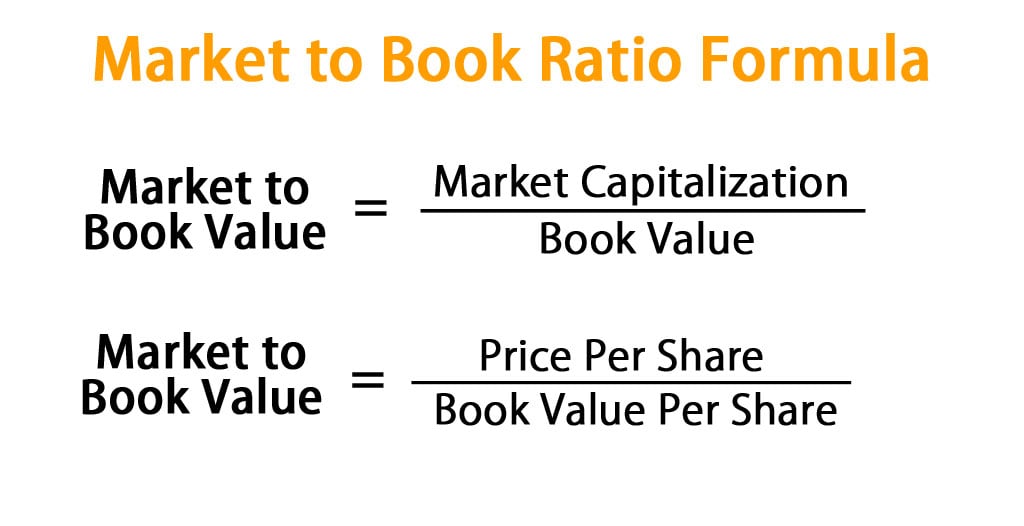

Price-to-book (P/B) ratio as a valuation multiple is useful when comparing similar companies within the same industry that follow a uniform accounting method for asset valuation. It can offer a view of how the market values a particular company’s stock and whether that value is comparable to the BVPS. Investors can calculate it easily if they have the balance sheet of a company of interest.

The figure that represents book value is the sum of all of the line item amounts in the shareholders’ equity section on a company’s balance sheet. As noted above, another way to calculate book value is to subtract a business’ total liabilities from its total assets. The book value of a company is based on the amount of money that shareholders would get if liabilities were paid off and assets were liquidated. The market value of a company is based on the current stock market price and how many shares are outstanding. To calculate the book value of a company, subtract the total liabilities from the total assets.

- You can use the book value per share formula to help calculate the book value per share of the company.

- Over time, these actions can increase the book value per share as the company gains a competitive edge through improved brand reputation, increased customer loyalty, and reduced risks.

- For companies seeking to increase their book value of equity per share (BVPS), profitable reinvestments can lead to more cash.

- Investors use BVPS to gauge whether a stock price is undervalued by comparing it to the firm’s market value per share.

BVPS offers a baseline, especially valuable for value investors looking for opportunities in underpriced stocks. The formula for BVPS involves taking the book value of equity and dividing that figure by the weighted average of shares outstanding. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of how does the new tax law affect my health insurance the intermediary or provide any assurance of returns to investors. The examples and/or scurities quoted (if any) are for illustration only and are not recommendatory. The P/B ratio, alternatively referred to as the price-equity ratio, is calculated based on the value of a company. Despite its importance, it can be intimidating for those not familiar with financial jargon.

A company poised to launch an innovative product or tap into a new market might have immense future earnings potential that the BVPS simply does not capture. Another major drawback of using BVPS to ascertain a company’s value is that it completely overlooks the entity’s future growth potential. Book value is a snapshot of a company’s value at a specific moment in time, capturing the company’s current assets without any consideration of its ability to generate future profits. To sum up, while both values serve crucial roles in valuation, they offer different lenses to evaluate a company’s worth. The book value per share looks at the company’s value from a liquidation standpoint, while market value per share reflects the value from the viewpoint of the broader investment market.

Undervalued stock that is trading well below its book value can be an attractive option for some investors. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors.